Renters Insurance in and around Ventura

Your renters insurance search is over, Ventura

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

There’s No Place Like Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented property or apartment, renters insurance can be the most sensible step to protect your personal items, including your silverware, running shoes, children's toys, hiking shoes, and more.

Your renters insurance search is over, Ventura

Coverage for what's yours, in your rented home

Renters Insurance You Can Count On

Renting a home is the right decision for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that won't help you replace your possessions. Renters insurance helps shield your personal possessions in case of the unexpected.

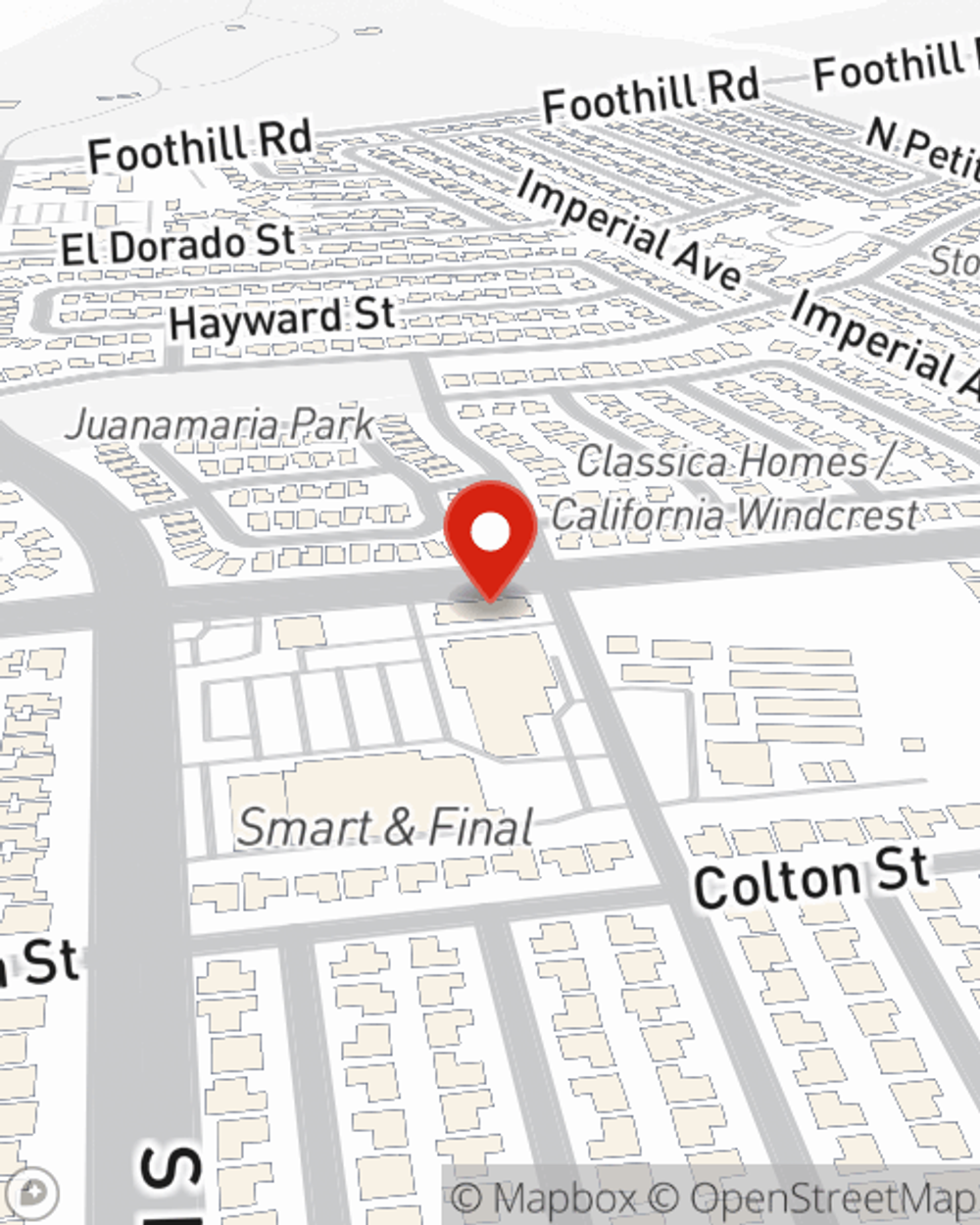

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Ventura. Call or email agent Stephanie Sipe's office to see about a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call Stephanie at (805) 941-3300 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Stephanie Sipe

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.